You might be tired of hearing about it but MPs aren’t done talking about it with just under 12 hours of the budget debate left to get through this week.

Fear not though, the usual question time will still happen and MPs will work through some other “Government orders of the day” which is just another way of saying legislation.

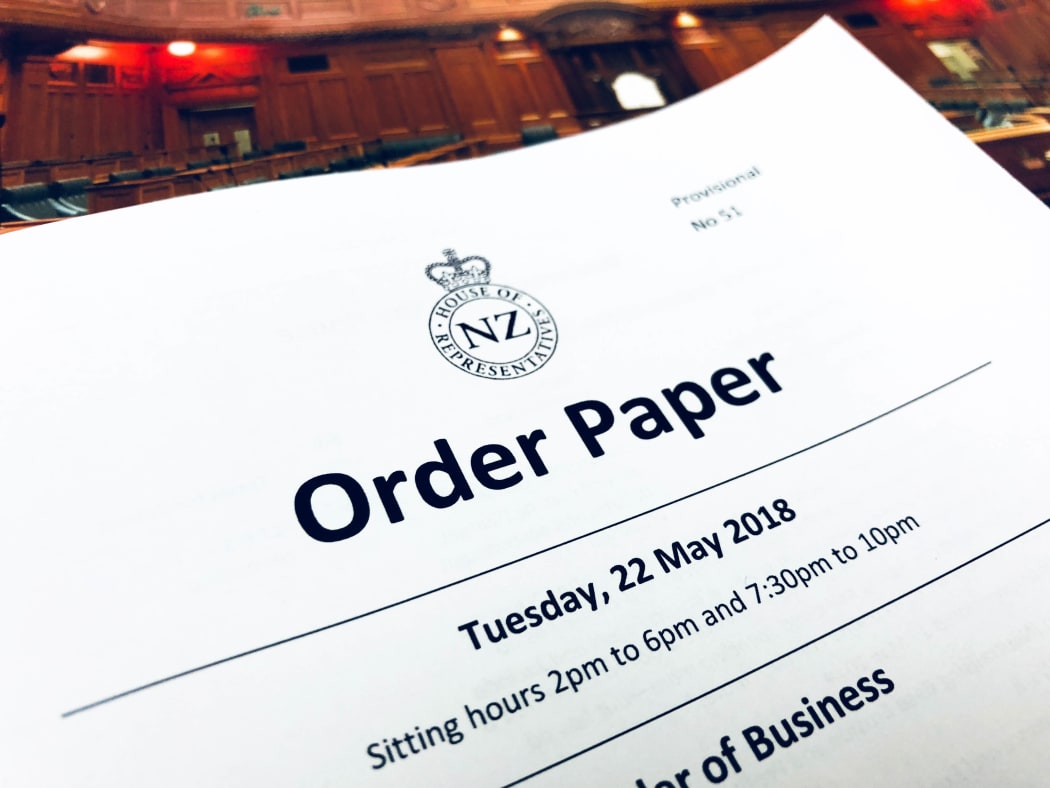

The plan for this week (May 22 - 24) is below.

Photo: VNP / Daniela Maoate-Cox

MPs are required to be at Parliament for scheduled sitting days, so called because MPs sit in those green leather chairs when they’re in the debating chamber. An agenda known as the Order Paper is published online each sitting day outlining what business the House plans to get through but there are always more items on the list than there is time for. Below is what they’ll attempt to get through.

Budget Debate continued (Tuesday, and Wednesday, and Thursday...)

What:

-

The continued second reading of the Appropriations (2018/19 Estimates) Bill (a.k.a the budget).

-

Eleven. Hours. Fifty. Minutes. Remaining. - a long talk but it’s spread out over the week after Question Time each day.

-

Last Thursday, Minister of Finance Grant Robertson introduced the Appropriations Bill which was read a first time without debate. Then he delivered a copy of his budget statement to the Speaker, Clerk, PM, other party leaders and Hansard.

-

The Minister of Finance then read the budget statement (it can take as long as he likes) as part of his speech to kick off the second reading of the Appropriations Bill.

-

The actual Budget Debate is usually started by the Leader of the Opposition (20 minutes), and followed by the other party leaders: the Prime Minister (Labour, 20 minutes), Deputy Prime Minister (NZ First, 20 minutes), Greens (20 Minutes), ACT (10 Minutes), other MPs (10 minutes each). The ‘other MPs’ is where we’re up to now.

Why:

-

Running a country costs money. And the Government needs permission from Parliament both to collect money and to spend it.

-

The budget debate is the beginning of a very long parliamentary process of approving the Government’s spending plan for the year from July 1st. It begins the debate on a piece of legislation [the Appropriations (2018/19 Estimates) Bill] which outlines spending on all the many dozens of aspects of the wider ‘government’ - from schools and hospitals, to spies and science; from artificial limbs to environmental protection, and from taxes to lotteries.

-

In total the debate lasts for 15 hours and then the various ‘Votes’ (the topic sections of the budget: Health, Education etc) go to various Select Committees to be examined and defended by Ministers before arriving back at the House for 11 hours of Committee Stage (the Appropriations Debate) and a three hour third reading.

That’s 29 hours or more of House time plus the many Select Committee meetings. -

Along with the Appropriations Bill, the Government will also ask Parliament to pass an Imprest Supply measure to actually give it some interim walking-around-money while the House considers the Appropriations.

Ka kite Families Commission (Wednesday and continued Thursday)

What:

-

The third reading for the Families Commission Act Repeal Bill.

-

Repeals the Families Commission Act 2003 and disestablish the Families Commission which operates as Superu.

Why:

-

The Act outlines the Commission’s main functions as advocating for the interests of families and monitoring/evaluating programmes in the social sector. The previous National led Government rejigged agencies and resources to support social investment which included setting up the Social Investment Agency and disestablishing the Families Commission or Superu. Some of the Commission’s functions have already been switched to the Ministry of Justice and the Ministry of Social Development.

Making multinationals pay tax (Wednesday)

What:

-

The second reading of the Taxation (Neutralising Base Erosion and Profit Shifting) Bill, receives the Bill back from Select Committee and debates whether to adopt any alterations the committee has suggested. The report includes many unanimously agreed suggestions for amendments.

Why:

-

Tax law is a bit like an arms race. Governments write laws to try and force companies and individuals to pay their share of tax, while they, in turn, look for loopholes to exploit so as to minimise their tax.

-

This bill focuses on BEPS tax avoidance schemes whereby multinationals move profits from high tax countries (NZ) to low tax countries (tax havens); so they can report a loss in NZ and a massive profit somewhere else where tax rates are negligible.

You can see how much the House gets done each sitting day by going here: Daily progress in the House